Loyalty programs give reward points to consumers for making purchases and let consumers redeem their reward points for gifts. By their very nature, reward points look like an alternative currency and quack like an alternative currency.

Blockchain lets them pass the Duck Test and become a alternative currency aka alt-coin.

I’ve heard of platforms that help brands build their loyalty programs on the blockchain. But I’ve come across only one loyalty program itself that’s already on the blockchain: Rakuten Coin.

Japan’s largest retailer recently announced a blockchain-based loyalty program on which reward points will be issued in the form of an alt-coin called Rakuten Coin. According to CoinDesk, Rakuten has moved US$ 9 billion worth of existing Super Points into the blockchain to give a fillip to Rakuten Coin.

Loyalty programs have a powerful value proposition because they offer rewards for spends anyway made by consumer. As a result, they’ve become very popular. According to reports, an average American is a member of seven loyalty programs, with some of them having as many as 15 loyalty cards in their wallet. I couldn’t find equivalent figures for the rest of the world but it’s safe to say that loyalty programs are dime a dozen in all countries.

In practice, however, their efficacy has been mixed.

Amazon Prime is widely hailed as the greatest driver of Amazon’s success. So are the frequent flyer programs of most airlines and loyalty programs of many credit cards.

On the other hand, Walmart (worldwide), Apple (USA), DMART (India) and Indigo Airlines (India) are examples of a few brands that have done very well without running a loyalty program.

What gives?

I attribute the mixed performance of loyalty programs to the notorious “too many loyalty programs, too few reward points” problem. (Irrelevance of gifts is another problem but, since it’s comparatively rarer, I’ll ignore it in the present context.)

I’ll illustrate this problem by taking the example of Joe Consumer. At the start of a year, Joe joins loyalty programs from three merchants, namely, Red Loyalty Program, Green Loyalty Program and Blue Loyalty Program.

Like any typical loyalty program, these programs work in the following manner:

- Joe gets Red Points when he shops at Red Merchant but not when he shops at other merchants; likewise with Green and Blue points.

- Red Points can be redeemed for gifts only under Red Loyalty Program; ditto Green and Blue Points. In other words, Red Points cannot be redeemed under Green or Blue Loyalty Programs

- Red Program requires a minimum of 300 Red Points for redemption; Green Program requires 500 Green Points; and Blue Program requires 100 Blue Points

- All reward points expire in one year

During the course of the year, Joe earns 100 Red Points, 200 Green Points and 50 Blue Points by shopping at Red, Green and Blue merchants respectively.

Joe starts from a blank slate next year and concludes, rightly, that he got nothing for being loyal to the three brands last year, so why bother being loyal to them this year.

To revive flagging interest in loyalty programs, brands and third party loyalty program providers have attempted a few tactics over the years. Chief among them are the following:

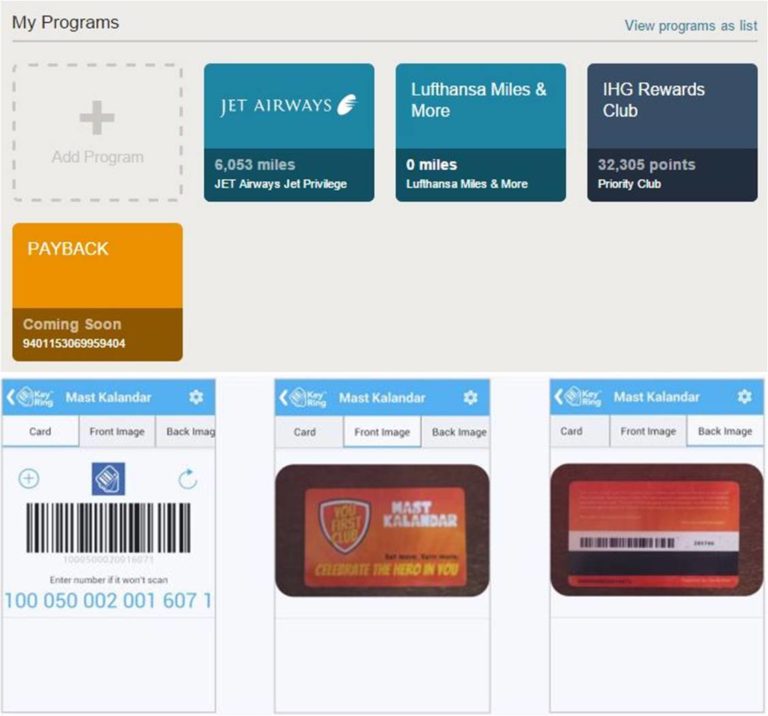

Reward exchanges should not be confused with loyalty consolidators like Using Miles and KeyRing. The latter merely help consumers manage multiple loyalty programs from a single portal / app, but they don’t support trading of points across programs. So, if points lapse before they’ve reached a level where they can be redeemed for something meaningful, tough luck – the only good news being you’ll get the bad news that your points have lapsed on all loyalty programs on a single portal / via single email from the loyalty consolidator.

- Coalition loyalty programs still permit points to be redeemed only within the program under which they’re earned. So, Red Points in the above example can still be redeemed only under the Red Loyalty Program and, if Joe doesn’t have enough of them, he loses them at the end of the year. Besides, coalition programs operate under one major constraint: They can accept only one Earn / Burn Partner per product category – or at least this is what I was told when Payback let go its existing fashion partner Big Megamart (now UNLIMITED) in India when it signed up the bigger fashion brand Fashion Big Bazaar (FBB). As a result, liquidity – industry speak for stores where reward points can be redeemed – is restricted to one brand / merchant per product category.

- While there has been a lot of buzz around reward exchanges over the years, I haven’t come across a single exchange that’s actually operational. That’s probably because of “breakage”, the term used in the loyalty industry to refer to reward points that are not redeemed. As industry insiders know, breakage can be as high as 30%. It’s open secret in the industry that breakage is baked into the business model of loyalty programs. So, consumers trying to trade reward points in one loyalty program for another will find themselves getting disproportionately lower number of reward points from the other program. When they learn this bitter truth, many consumers prefer to hold on to their original reward points instead of trading them at a discount. This severely undermines the utility of reward exchanges even though they sound great in theory.

So, despite years of efforts, the “too many programs, too few points” problem hasn’t gone away and the performance of loyalty programs remains lacklustre.

Blockchain can provide a huge shot in the arm to loyalty programs and raise their performance to the next level.

Key Metrics of a Loyalty Program

Earn Ratio = # of Reward Points Earned / Spend Amount (1 Reward Point / 100 INR)

Burn Ratio = Value of Gift / # of Reward Points Redeemed (25 Paise / 1 Reward Point)

Loyalty Program Value = Earn Ratio * Burn Ratio = Value of Gift / Spend Amount (25 Paise / 100 INR*100% = 0.25%)

Let’s see how, by using Rakuten’s blockchain loyalty program as an example.

Coming to redemption, it’s a no-brainer that Rakuten Coin should be redeemable for gifts at all Rakuten Group companies.

But that’s not enough – stopping there would merely amount to applying the blockchain lipstick on traditional coalition loyalty programs.

Ideally, Rakuten Coin should be accepted universally. But, in the real world, it’s virtually impossible for Rakuten to negotiate with each and every non-Rakuten merchant in the world – or even Japan – to accept Rakuten Coin.

Fortunately, it doesn’t need to. This is where the other benefit of “blockchaining” a loyalty program comes in.

Blockchain offers more than just the ability to convert reward points to an alt-coin.

As MIT Technology Review explains in Let’s Destroy Bitcoin: “These tokens are not unlike the points systems and gift cards that companies have used to hem in their customers for decades. What changes when you record these assets on a blockchain is that they become easily and securely transferable.”

Blockchain also allows Rakuten to list Rakuten Coin on leading cryptoexchanges. This will have two benefits:

Unlimited liquidity. Consumers will be able to freely trade their Rakuten Coins for Bitcoin and other cryptocurrencies that are already accepted by tens of thousands of merchants (many of whom may not even have heard of Rakuten). The question of where Rakuten Coins can be redeemed now becomes moot – it can be converted to cash or cash equivalent virtually everywhere. This will also solve the problem of not having enough reward points to qualify for the minmum limit set by conventional loyalty programs to redeem them because most exchanges don’t have a minimum trading lot size these days.

Buoyancy. Cryptoexchange listing will inject buoyancy into Rakuten Coin, even if the added lift is largely speculative in nature at this point. When Joe finds that his $100 worth of Green Points gets him only $70 worth of Blue Points, he’s bound to have a misgiving. But, if he gets the same value in a cryptocurrency, the crypto’s buoyancy will counter that misgiving. It’s human nature to rationalize today’s deficit as an investment if there’s a chance of earning multibagger returns on it in future. (Ditto corporate nature, going by Aswath Damodaran’s take on the premium paid by Walmart for Flipkart. Writing in Economic Times, the Professor of Finance, Stern School of Business, New York University, observes, “where you have hundreds of billions of dollars in play, a multibillion premium paid on an acquisition is penny change.”) From my back-of-the-envelope calculations, 1 trillion Super Points have been converted to Rakuten Coin worth $9.1 billion. This translates to a Burn Ratio of $9.1B/1T Points i.e. 0.0091 $ / Point, or almost 1 cent per point. This is 2.5X of Payback’s burn ratio of 0.4 cents per point (being $ equivalent of 0.25 INR / Point). So Rakuten Coin is already exhibiting buoyancy.

This is how Blockchain can help Rakuten – and other brands – to crack the Holy Grail of loyalty programs.

By harnessing the full capabilities of the blockchain, loyalty programs can delight consumers.

That should be benefit enough for brands to embrace the blockchain for their loyalty programs.

DISCLAIMER: The Blockchain world has an eclectic mix of elements like cryptocoin, ICO, and so on whose legal status is ambiguous and swings wildly between various states of the spectrum such as illegal, maybe-illegal, not-illegal and legal and from one country to another. Before following through with the guidance given in this post, please consult your legal counsel about their legal status in your respective jurisdiction. We offer no guarantees as to legality of any of the guidance provided in this post.

Author : Ketharaman Swaminathan

Website : GTM360